Friday, August 30, 2013

The Obvious Goes Postal

Maybe the alternate title for this one is "The Fed Is Hoist By Its Own Petard".

The problem the Fed has is that both real and price-adjusted consumption are at or below their post WWII recession lines. Thus, withdrawing QE, if it does anything, would be expected to push the economy into a recession.

But the second problem the Fed has is that if it doesn't withdraw QE and the economy continues to recover, that all-essential green line (real consumption) is going to be hamstrung by inflation and the result will be to push the economy into a recession. Also business investment is doomed to be low because of the sharp rise in tax rates, especially on capital gains taxes.

Looking at the same graph, but with YoY changes in currency:

The economy is still compensating and not slumping, but it's scraping along with abysmally low expansion rates. The implication is that even minor inflation is too much for the market to bear, because it will push real consumption down too low to avoid a downturn.

So why is real consumption so low? Well, let's look at nominal employee compensation:

Despite financial-press talk about employment driving consumption, it's rather obvious that in fact it cannot. YoY changes in nominal employee compensation can only drive nominal consumption changes at about the same rate. Because most SS recipients are losing real income, it is only new disability and retirement awards that can add spendable income, and even at the current accelerated pace, it's not enough to push growth. It sustains it where ordinarily we would already have fallen through the thinning ice, but it can't do much more than that.

It's almost as if this thing is correlated or something. Take heart - this means most Americans are honest and don't steal for a living.

One of the results of the Fed's current QE binge has been the destruction of the housing market for most people. The price increases on property have exceeded what many first-time borrowers can pay, so the housing recovery is narrowing now to investor-dominated. This is not encouraging, because it implies for the Fed that either it must go Abe NOW - announcing QE this fall to continue for several more years at close to the current levels - or it must begin to taper and let the Black Rocks rock on down to their losses so individuals can participate.

Autos are exhausted (judging by used-car interest rates), and only the housing market is left. But you have to print a JACKWAD of money to keep an investor-led housing recovery going. If they choose that option, they need to go big time. We'll know by November. All bets are off.

My guess is that the Fed may go Abe now. They probably don't have the guts to take their medicine. I would in fact be sure, except for a minor technical problem.

If the Fed does go Abe (which is not going to work there, btw), the Fed should actually increase the monthly buy-in. A few small holes have developed in the business plans of the larger housing investors, and it takes a lot of monetary muscle to patch such holes. Here there's a problem. What do they buy? They're pretty well maxed out on Treasuries already. Mortgages don't offer them a solution either:

The problem with an investor-based housing recovery is that it doesn't generate the increase in mortgage bonds you need. Too much of it is cash-based, or direct borrowing from banks:

Maybe the Fed should just double down and directly buy the houses!!!! I'd recommend starting in Richmond, CA. They've got a very good stimulative plan in place - seize the property. Alternatively the Fed could just buy stocks.

If this weren't our economy, this would all be terribly funny. But it is our economy, so it is not.

The global economy has very much of an early 2008 feel to it. This next few months are going to be interesting.

Syria is of course a wild card, but if the president bombs Syria, he pretty much bombs the US economy. So don't expect the Fed to taper in September. I don't think it can. It must wait to find out what will be done on the debt limit, so it knows what the supply of Treasuries will be. And it must wait to find out whether oil is going to go to impossible levels.

I think the Fed has already lost control of the money supply, so they might as well taper ASAP. The duration of the adjustment matters as much as the adjustment itself. It's possible a sharp taper could trigger a massive expansion in the US money supply and a big upward move in oil rates (way to speculate on the USD if you don't want to be in stocks), but that would be self-healing. Also mortgage rates will be self-healing too. Because mortgage rates are already constraining sales, there is a natural shift down in mortgage rates. The cost would be a short downturn, but it would be short.

But I don't think the Fed is realistic at all. I think they are now afraid of everything - as well they should be. By any realistic standard, the US economy is at its weakest point since the end of the recession.

The problem the Fed has is that both real and price-adjusted consumption are at or below their post WWII recession lines. Thus, withdrawing QE, if it does anything, would be expected to push the economy into a recession.

But the second problem the Fed has is that if it doesn't withdraw QE and the economy continues to recover, that all-essential green line (real consumption) is going to be hamstrung by inflation and the result will be to push the economy into a recession. Also business investment is doomed to be low because of the sharp rise in tax rates, especially on capital gains taxes.

Looking at the same graph, but with YoY changes in currency:

The economy is still compensating and not slumping, but it's scraping along with abysmally low expansion rates. The implication is that even minor inflation is too much for the market to bear, because it will push real consumption down too low to avoid a downturn.

So why is real consumption so low? Well, let's look at nominal employee compensation:

Despite financial-press talk about employment driving consumption, it's rather obvious that in fact it cannot. YoY changes in nominal employee compensation can only drive nominal consumption changes at about the same rate. Because most SS recipients are losing real income, it is only new disability and retirement awards that can add spendable income, and even at the current accelerated pace, it's not enough to push growth. It sustains it where ordinarily we would already have fallen through the thinning ice, but it can't do much more than that.

It's almost as if this thing is correlated or something. Take heart - this means most Americans are honest and don't steal for a living.

One of the results of the Fed's current QE binge has been the destruction of the housing market for most people. The price increases on property have exceeded what many first-time borrowers can pay, so the housing recovery is narrowing now to investor-dominated. This is not encouraging, because it implies for the Fed that either it must go Abe NOW - announcing QE this fall to continue for several more years at close to the current levels - or it must begin to taper and let the Black Rocks rock on down to their losses so individuals can participate.

Autos are exhausted (judging by used-car interest rates), and only the housing market is left. But you have to print a JACKWAD of money to keep an investor-led housing recovery going. If they choose that option, they need to go big time. We'll know by November. All bets are off.

My guess is that the Fed may go Abe now. They probably don't have the guts to take their medicine. I would in fact be sure, except for a minor technical problem.

If the Fed does go Abe (which is not going to work there, btw), the Fed should actually increase the monthly buy-in. A few small holes have developed in the business plans of the larger housing investors, and it takes a lot of monetary muscle to patch such holes. Here there's a problem. What do they buy? They're pretty well maxed out on Treasuries already. Mortgages don't offer them a solution either:

The problem with an investor-based housing recovery is that it doesn't generate the increase in mortgage bonds you need. Too much of it is cash-based, or direct borrowing from banks:

Maybe the Fed should just double down and directly buy the houses!!!! I'd recommend starting in Richmond, CA. They've got a very good stimulative plan in place - seize the property. Alternatively the Fed could just buy stocks.

If this weren't our economy, this would all be terribly funny. But it is our economy, so it is not.

The global economy has very much of an early 2008 feel to it. This next few months are going to be interesting.

Syria is of course a wild card, but if the president bombs Syria, he pretty much bombs the US economy. So don't expect the Fed to taper in September. I don't think it can. It must wait to find out what will be done on the debt limit, so it knows what the supply of Treasuries will be. And it must wait to find out whether oil is going to go to impossible levels.

I think the Fed has already lost control of the money supply, so they might as well taper ASAP. The duration of the adjustment matters as much as the adjustment itself. It's possible a sharp taper could trigger a massive expansion in the US money supply and a big upward move in oil rates (way to speculate on the USD if you don't want to be in stocks), but that would be self-healing. Also mortgage rates will be self-healing too. Because mortgage rates are already constraining sales, there is a natural shift down in mortgage rates. The cost would be a short downturn, but it would be short.

But I don't think the Fed is realistic at all. I think they are now afraid of everything - as well they should be. By any realistic standard, the US economy is at its weakest point since the end of the recession.

Friday, August 23, 2013

Tapering for Rednecks

I'm feeling better, so I thought I'd share the humor with you all.

Despite the many fascinating analyses of the FedStrat one can read, the reality is that the Fed has a minor technical problem with its asset buying program.

To understand this problem, you do not need a degree in advanced financial matters. You need a brain, and possibly a little banking or business experience.

The reality is that banking stability is entirely dependent on stable collateral value and stable storage of necessary banking reserves. The reason there are all those empty buildings all over China, including some almost-empty cities, is that the Chinese financial system does not produce stable collateral value. Thus they have to build it. No collateral = extreme financial instability when the music stops.

The banking system in the developed world is also dependent on stable collateral and stable reserves, which is the reason that government-issued securities (sovereigns) are so important. They will become ever more important, as this Bloomberg article gracefully hints:

Okay, so if the basic rule is that STABLE credit expansions are limited by collateral, and if a central bank starts buying all the collateral used for banking reserves, then doesn't the basic rule imply that commodity costs must rise? And when commodity costs do rise, doesn't that mean that demand for collateral on bottom-level lending must escalate?

Think of it this way. A bank lends and knows that some of its lending will produce losses. Thus it reserves a certain portion of its profits to cover those future losses. It has to put that money somewhere. In the developed world, a big piece of those reserves have normally been stored in sovereign and sovereign-guaranteed bonds. Alternatively, it must put its reserves on deposit at the Fed.

Now the amount of reserves (which reduce profits) that a bank stores this way are related to lending risks, and lending risks are related to collateral. Collateral relating to commercial loans goes from the dicey to the PDG, in this ascending order:

1) Future profits (future cash flow surpluses).

2) Current operating reserves of the company plus cash. This means that the lender could hold or take an interest in cash deposits or have the company pledge its working accounts. In practice, you can't take money that the company needs to fund its future cash flow without ditching your own loan, so it's really excess operating reserves of the company.

3) Stock (if the company is public).

4) Hard assets. These are not generally very liquid, but they run from warehouses full of quantam-tunneled zinc and copper in China to things like office buildings, trucks, and manufacturing inventory. Except for things like office buildings, which if owned can be sold with a lease-back option, most manufacturing-type assets are needed for company operation, and thus can only be liberated in a liquidation, which may force future additional losses on your loan. However if a company owns ships or a truck fleet, you may be able to liberate value by transferring ownership with leases without putting the company out of business and ditching your own loan.

5) Securities, such as government bonds or government-insured bonds or commercial securities insured by a reputable insurer which are owned and pledged by the borrower as collateral for your loans.

So in the end, when things go bad the entire chain is still acutely dependent on cash and government bonds. If things really go bad, the liberation value of trucks or ships or office buildings may become minimal. Four years later you may recover your losses that way, but in the current period, you have to recognize losses on the loan. Stock value is highly variable over the short term. In widespread downturns, the relative values of government bonds or government-insured bonds go up, so that is your best real liquid collateral option other than cash. The longer term the better, because the yields on the short bonds will drop, so having a nice juicy 10 year government bond with a relatively high yield compared to short-term interest rates in a downturn is better than gold.

Now what happens when a central bank acquires a lot of the stable securities? Hmmm? The Fed currently has about 2 Trillion in US Treasuries. It's currently buying 40 billion a month, so at the current pace it will have about 2.25 trillion in another six months. The Fed wanted to shift this mix to long bonds to suppress mortgage interest rates. Here we might wonder what is available, and according to the Treasury:

The Fed is exhausting the supply of longer yield bonds and bills. Therefore a lot of its holdings are in shorter durations still. The Fed cannot afford to become the market here, and it looks like it may end up with 20% of the total supply if it sticks to the May schedule. If you want to be a little less redneck about it, the Chicago Fed has a presentation by Win Analytics up.

The Fed is exhausting the supply of longer yield bonds and bills. Therefore a lot of its holdings are in shorter durations still. The Fed cannot afford to become the market here, and it looks like it may end up with 20% of the total supply if it sticks to the May schedule. If you want to be a little less redneck about it, the Chicago Fed has a presentation by Win Analytics up.

The Fed started buying the 40 billion NEW a month of Treasuries in December. As of the end of November, 2012, total federal debt held by the public was 11.55 trillion. As of August, it is just under 11.95 trillion. Thus over 10 months the new Treasuries buying by the Fed corresponds to almost all Treasury new issuance. The Fed did not in fact expect the supply of Treasuries to be constrained to this degree, and, and there is "hidden" issuance that hasn't emerged yet due to debt ceiling constraints. Yet still the Fed is an awkward position here. No doubt the Fed is waiting to see what is going to happen with the debt limit negotiations and future budget negotiations, and it will really make its decision on Treasury buying once it catches a political clue.

Still the quandary remains. In an expanding economy, the need for working capital and stable collateral values must expand. If stable collateral values cannot expand to the private market, then one would expect net market interest rates to rise to compensate, which would constrain economic growth and load more risk into the financial system. Companies would then be constrained in expansion by the need to store cash and fund new operating expenditures more from profit, or the need to buy hard assets to create collateral reserves, which has a natural limit.

In this respect, understanding why oil prices are rising as they are is no mystery.

All the tch-tching about the Fed removing stimulus too early is technically accurate,

because by all historical standards, the US has hardly escaped from the last downturn, but has since accumulated rising debt levels, and now faces higher federal taxes which must drag on growth, plus the accumulated drag from old-age funding and the collateral degeneration of state and local finances across a wide range of US territory. There are significant drags and the drags are probably accumulative.

In particular, the flat utility production curve over seven years says something rather dire about the real state of the US economy and real GDP growth. Nonetheless, the business rebound indicates that we have a growing need for strong collateral to fund a genuine, if slow, expansion, and that implies that the natural result of Fed actions is already coming close to slowing economic growth.

The Fed may have to dump Treasuries out there again through reverse repos. Velocities are still dropping, and I can't understand the Fed's current policy in any other way but as a velocity drag:

In the short term, the shortage is being met by stripping Treasuries from bank holdings, but this can't continue for too much longer. The very high percentage of cash-funded home sales shows that we are shifting to the China model, and the Fed cannot continue its current strategy for too much longer.

Home affordability is now falling dramatically, and there is nothing the Fed can do to stop the process. The strongest lending gains we now have are car and student loans, and this doesn't bode well.

The solution is clearly not to create an Italian-type situation, in which theoretical bank reserves are stored in theoretical sovereign bonds. The eventual detonation there is going to be most impressive.

Despite the many fascinating analyses of the FedStrat one can read, the reality is that the Fed has a minor technical problem with its asset buying program.

To understand this problem, you do not need a degree in advanced financial matters. You need a brain, and possibly a little banking or business experience.

The reality is that banking stability is entirely dependent on stable collateral value and stable storage of necessary banking reserves. The reason there are all those empty buildings all over China, including some almost-empty cities, is that the Chinese financial system does not produce stable collateral value. Thus they have to build it. No collateral = extreme financial instability when the music stops.

The banking system in the developed world is also dependent on stable collateral and stable reserves, which is the reason that government-issued securities (sovereigns) are so important. They will become ever more important, as this Bloomberg article gracefully hints:

Banks are facing a growing list of demands from regulators to seek out highly liquid assets as authorities move to bolster the resilience of the financial system. Re-use of collateral is one way that lenders can satisfy the tougher rules, amid warnings from banks that there may not be enough highly liquid securities available to satisfy accumulating requirements from supervisors.If the world literally runs out of collateral, the rush into hard assets is inevitable. It's a pretty good guess that warehouses in China stacked full of commodities are also used in the collateral rush. It's also a pretty good guess that the same piles of commodities are instantaneously quantam-tunneled from one warehouse to another on financial statements. Advanced lending physics, that.

Okay, so if the basic rule is that STABLE credit expansions are limited by collateral, and if a central bank starts buying all the collateral used for banking reserves, then doesn't the basic rule imply that commodity costs must rise? And when commodity costs do rise, doesn't that mean that demand for collateral on bottom-level lending must escalate?

Think of it this way. A bank lends and knows that some of its lending will produce losses. Thus it reserves a certain portion of its profits to cover those future losses. It has to put that money somewhere. In the developed world, a big piece of those reserves have normally been stored in sovereign and sovereign-guaranteed bonds. Alternatively, it must put its reserves on deposit at the Fed.

Now the amount of reserves (which reduce profits) that a bank stores this way are related to lending risks, and lending risks are related to collateral. Collateral relating to commercial loans goes from the dicey to the PDG, in this ascending order:

1) Future profits (future cash flow surpluses).

2) Current operating reserves of the company plus cash. This means that the lender could hold or take an interest in cash deposits or have the company pledge its working accounts. In practice, you can't take money that the company needs to fund its future cash flow without ditching your own loan, so it's really excess operating reserves of the company.

3) Stock (if the company is public).

4) Hard assets. These are not generally very liquid, but they run from warehouses full of quantam-tunneled zinc and copper in China to things like office buildings, trucks, and manufacturing inventory. Except for things like office buildings, which if owned can be sold with a lease-back option, most manufacturing-type assets are needed for company operation, and thus can only be liberated in a liquidation, which may force future additional losses on your loan. However if a company owns ships or a truck fleet, you may be able to liberate value by transferring ownership with leases without putting the company out of business and ditching your own loan.

5) Securities, such as government bonds or government-insured bonds or commercial securities insured by a reputable insurer which are owned and pledged by the borrower as collateral for your loans.

So in the end, when things go bad the entire chain is still acutely dependent on cash and government bonds. If things really go bad, the liberation value of trucks or ships or office buildings may become minimal. Four years later you may recover your losses that way, but in the current period, you have to recognize losses on the loan. Stock value is highly variable over the short term. In widespread downturns, the relative values of government bonds or government-insured bonds go up, so that is your best real liquid collateral option other than cash. The longer term the better, because the yields on the short bonds will drop, so having a nice juicy 10 year government bond with a relatively high yield compared to short-term interest rates in a downturn is better than gold.

Now what happens when a central bank acquires a lot of the stable securities? Hmmm? The Fed currently has about 2 Trillion in US Treasuries. It's currently buying 40 billion a month, so at the current pace it will have about 2.25 trillion in another six months. The Fed wanted to shift this mix to long bonds to suppress mortgage interest rates. Here we might wonder what is available, and according to the Treasury:

The Fed is exhausting the supply of longer yield bonds and bills. Therefore a lot of its holdings are in shorter durations still. The Fed cannot afford to become the market here, and it looks like it may end up with 20% of the total supply if it sticks to the May schedule. If you want to be a little less redneck about it, the Chicago Fed has a presentation by Win Analytics up.

The Fed is exhausting the supply of longer yield bonds and bills. Therefore a lot of its holdings are in shorter durations still. The Fed cannot afford to become the market here, and it looks like it may end up with 20% of the total supply if it sticks to the May schedule. If you want to be a little less redneck about it, the Chicago Fed has a presentation by Win Analytics up. The Fed started buying the 40 billion NEW a month of Treasuries in December. As of the end of November, 2012, total federal debt held by the public was 11.55 trillion. As of August, it is just under 11.95 trillion. Thus over 10 months the new Treasuries buying by the Fed corresponds to almost all Treasury new issuance. The Fed did not in fact expect the supply of Treasuries to be constrained to this degree, and, and there is "hidden" issuance that hasn't emerged yet due to debt ceiling constraints. Yet still the Fed is an awkward position here. No doubt the Fed is waiting to see what is going to happen with the debt limit negotiations and future budget negotiations, and it will really make its decision on Treasury buying once it catches a political clue.

Still the quandary remains. In an expanding economy, the need for working capital and stable collateral values must expand. If stable collateral values cannot expand to the private market, then one would expect net market interest rates to rise to compensate, which would constrain economic growth and load more risk into the financial system. Companies would then be constrained in expansion by the need to store cash and fund new operating expenditures more from profit, or the need to buy hard assets to create collateral reserves, which has a natural limit.

In this respect, understanding why oil prices are rising as they are is no mystery.

All the tch-tching about the Fed removing stimulus too early is technically accurate,

because by all historical standards, the US has hardly escaped from the last downturn, but has since accumulated rising debt levels, and now faces higher federal taxes which must drag on growth, plus the accumulated drag from old-age funding and the collateral degeneration of state and local finances across a wide range of US territory. There are significant drags and the drags are probably accumulative.

In particular, the flat utility production curve over seven years says something rather dire about the real state of the US economy and real GDP growth. Nonetheless, the business rebound indicates that we have a growing need for strong collateral to fund a genuine, if slow, expansion, and that implies that the natural result of Fed actions is already coming close to slowing economic growth.

The Fed may have to dump Treasuries out there again through reverse repos. Velocities are still dropping, and I can't understand the Fed's current policy in any other way but as a velocity drag:

In the short term, the shortage is being met by stripping Treasuries from bank holdings, but this can't continue for too much longer. The very high percentage of cash-funded home sales shows that we are shifting to the China model, and the Fed cannot continue its current strategy for too much longer.

Home affordability is now falling dramatically, and there is nothing the Fed can do to stop the process. The strongest lending gains we now have are car and student loans, and this doesn't bode well.

The solution is clearly not to create an Italian-type situation, in which theoretical bank reserves are stored in theoretical sovereign bonds. The eventual detonation there is going to be most impressive.

Thursday, August 15, 2013

Nicely Summed Up

The government does want all your health records in shareable databases, and that includes your imaging.

Tuesday, August 13, 2013

This Might Be Significant

Hathaway at NASA:

.

And indeed the shift from intenser, shorter cycles to longer/lower cycles does seem to have a high correlation with that mysterious pause in warming which has so embarrassed the UK Met. It is, we are told by so many, utterly mysterious.

Over the longer term, it seems clear that solar activity is not the only contributor to global temperatures:

But yet it also seems to be a factor. Other correlated factors seem to be the Pacific and Atlantic oscillations. Earth temps and the AMO and PDO oscillations are all part of one system. Sunspot cycles are an external influence which may or may not be influencing this system, but certainly cannot be driven by the Earth climate. Solar activity is independent.

One might wonder whether the oscillations themselves have something to do with sunspot cycle/temperature variances over time:

One suspects there may be for the PDO.

Everything here is meaned on 60, to make it all clearer. Hadcrut3 has been added for temps (purple line):

We have too short a data series to be sure of anything, because picking foreign drivers out of natural oscillations in systems is a hard task. It may be that PDO follows.

We have too short a data series to be sure of anything, because picking foreign drivers out of natural oscillations in systems is a hard task. It may be that PDO follows.

Same thing, meaned over 120 samples:

Looking at these last two graphs, I suspect that temps push PDO, but that changes in sunspot cycle intensities and lengths kind of "shake" AMO, thus suggesting a possible mechanism by which solar cycle changes might have an intensified effect on earth climate (aside from pure energy inputs). What I am hypothesizing is basically that shorter/stronger sunspot cycles insert more energy into the natural Atlantic oscillation, enhancing its swings, and that slower, weaker sunspot cycles dampen the AMO oscillation.

Tisdale's website has a lot of info on AMO and northern latitude warming. I don't have an opinion on causation, but it does seem that high AMO correlates with warmer Arctic.

Normally, AMO seems to go into its high phase and bobble around there for quite some time, meaning that one would expect a warmer Arctic and higher AMO for some years to come (240 sample mean):

But, if my theory is true, the phase shift on the AMO might be more acute because of the shift in sunspot activity, if indeed the lower solar activity persists for several cycles.

This all matters only if you like to eat. There's a huge amount of arable land up in the higher northern hemispheres, but historically northern crop failures have correlated with drops in sunspot cycles.

There is also real debate about whether we are overstating the difference in sunspot cycles due to better observations, which thus overstate recent variability as opposed to historical variability.

There is one thing of which I am certain, and that is that while CO2 should have some temperature effect, the "pure" CO2 effect just can't be that strong. Tropospheric temperatures should be the most sensitive to CO2-caused temperature variations, and look what happened to those when the sunspot cycle shifted:

It may be that CO2 prevents temperatures from falling as fast as they otherwise would, because it is trapping more heat. But it cannot be that CO2 alone has driven all the temperature rise recently, because its effect in the atmosphere is just not suddenly going to change. Lord knows CO2 levels aren't dropping and aren't going to drop any time soon.

In terms of predictions, so far the current people have dropkicked the climate scientists all the way around the globe, and now the solar people are lining up for the next go-round.

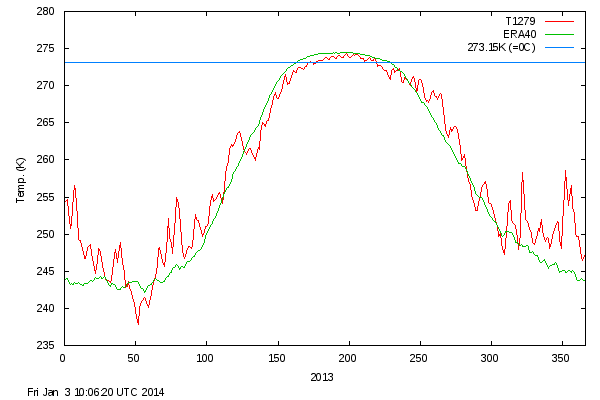

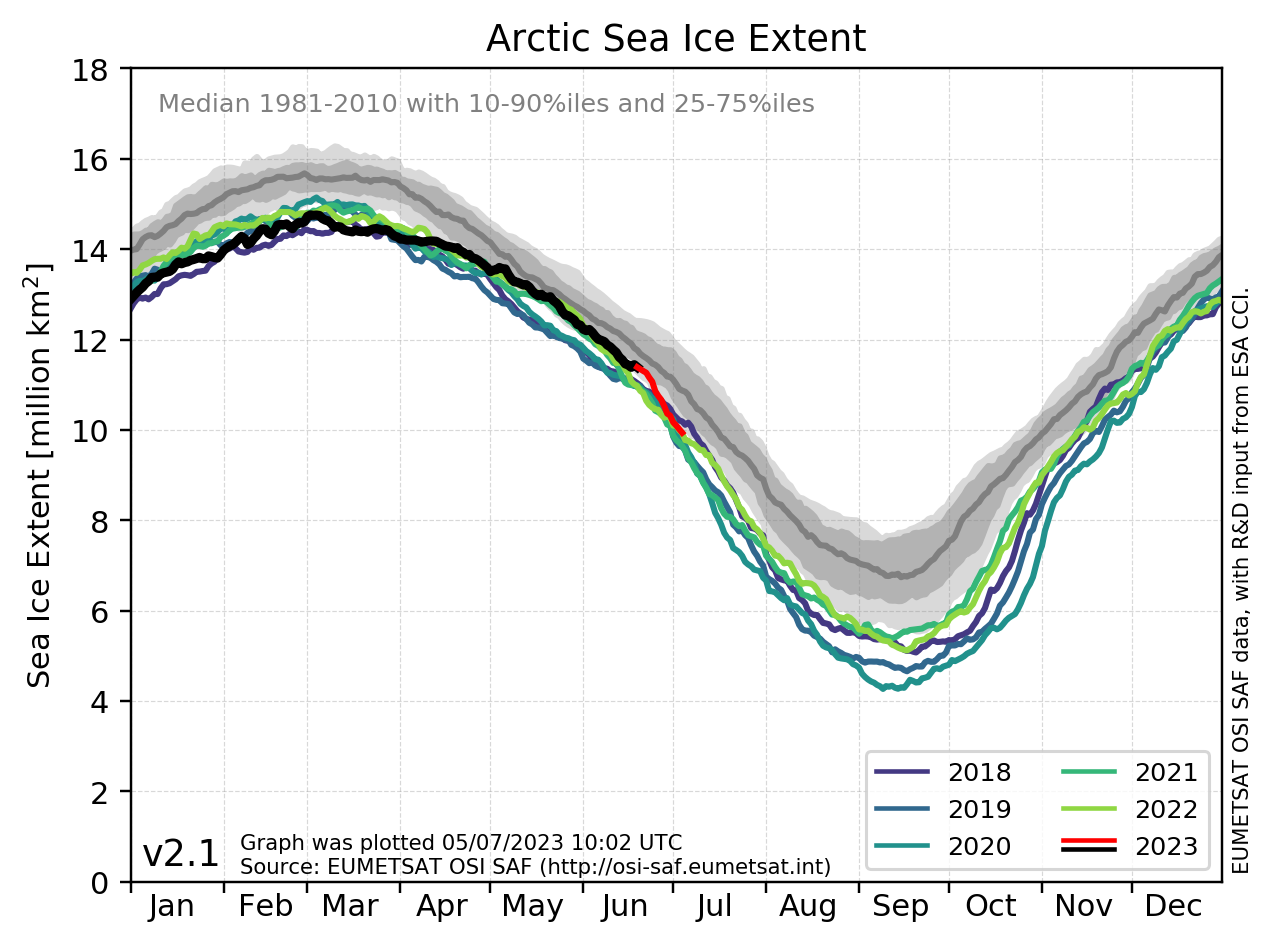

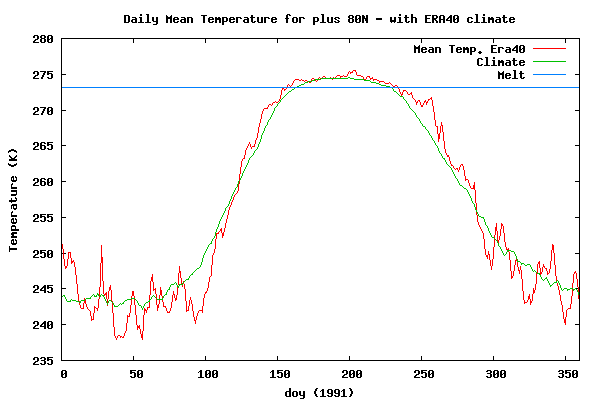

And the thing is, folks, that it's been a cold summer in the Arctic:

But what's odd about this is that we are pretty much at solar maximum. If you go to the website from which I thieved the graph, you discover that you can flip back and look at Arctic temps since 1958.

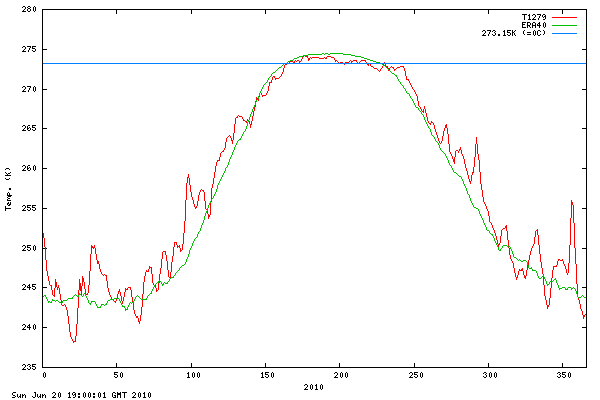

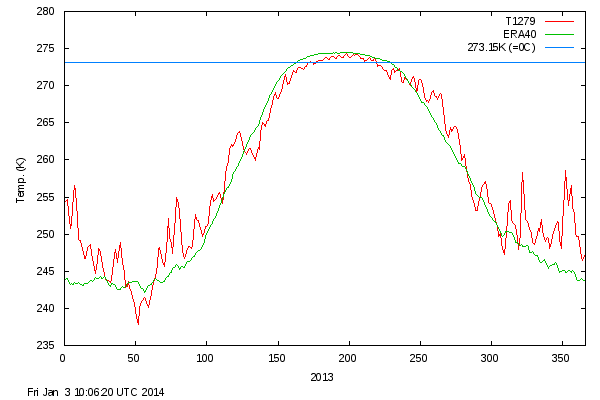

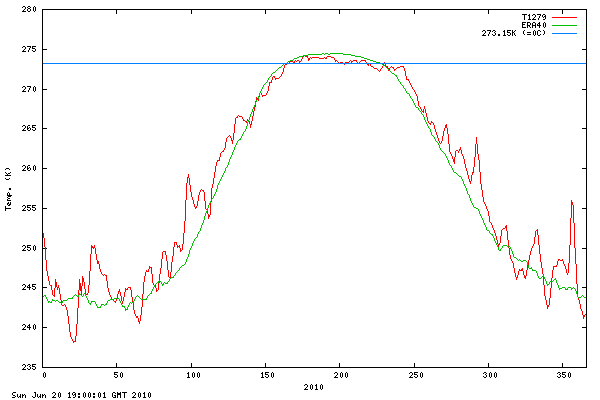

2009/2010 was the last solar minimum:

It was cold. You can plot all sorts of climate series at ESRL NOAA. So I did:

Purely out of random curiosity, I thought I'd use the first website to see if there was any pattern in summer Artic temperatures between sunspot maximums and minimums. And you know, there did seem to be a small but persistent effect. Try it yourself.

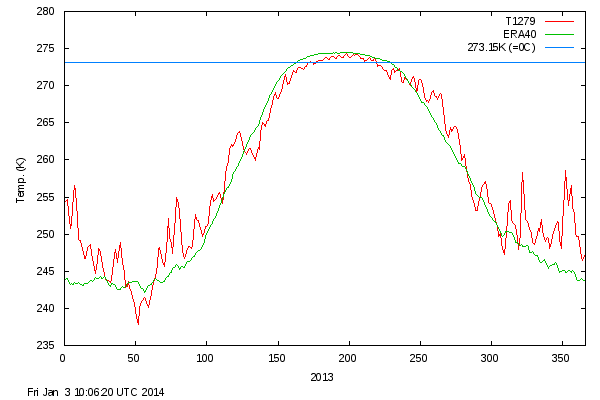

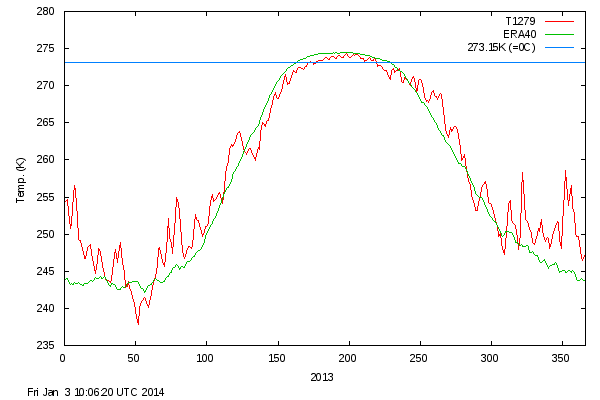

But this year, it's darned cold up there at solar maximum:

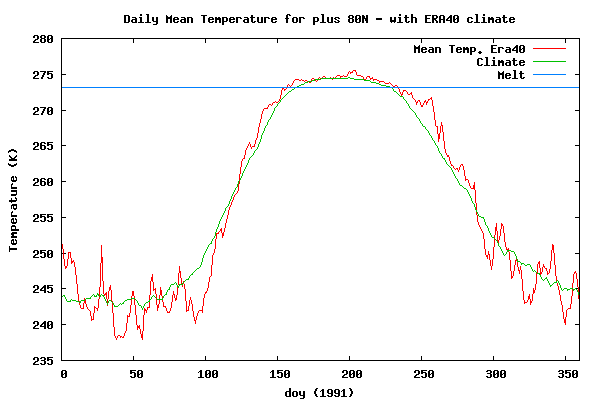

Which looks quite different from the last biggie, 1991:

All of which made me wonder if maybe it's time to stop hoarding gold, and start hoarding pasta?

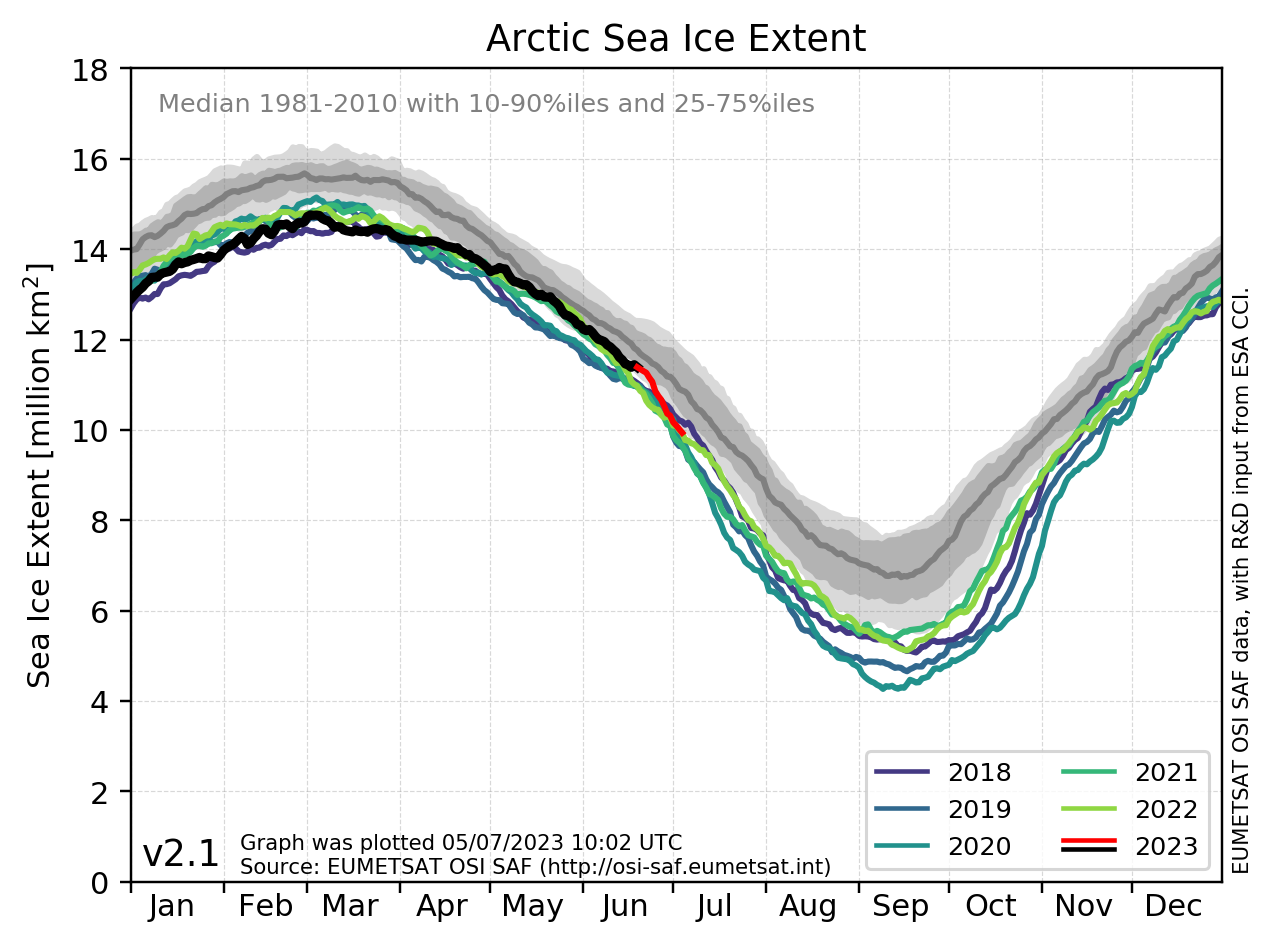

And no, the Arctic is not exactly a lake this year:

At this point, if he were alive my father would be in fits of laughter, cheerfully reminding us all that he had always said that in terms of reliability between the sciences, geology came first, followed by physics. Sociology dead last. Yes, Dad, you were right - but I think we have a new contestant for dead last in climate science.

Although I do not know what it all means, I suspect that investing in farmland in Canada is not the wisest strategy.

We are currently over four years into Cycle 24. The current predicted and observed size makes this the smallest sunspot cycle since Cycle 14 which had a maximum of 64.2 in February of 1906There has historically been a high correlation between changes in sunspot cycle lengths and intensities and US global temperatures. Five years ago I played with all the available numbers and came up with a three to five year lagged effect:

.

And indeed the shift from intenser, shorter cycles to longer/lower cycles does seem to have a high correlation with that mysterious pause in warming which has so embarrassed the UK Met. It is, we are told by so many, utterly mysterious.

Over the longer term, it seems clear that solar activity is not the only contributor to global temperatures:

But yet it also seems to be a factor. Other correlated factors seem to be the Pacific and Atlantic oscillations. Earth temps and the AMO and PDO oscillations are all part of one system. Sunspot cycles are an external influence which may or may not be influencing this system, but certainly cannot be driven by the Earth climate. Solar activity is independent.

One might wonder whether the oscillations themselves have something to do with sunspot cycle/temperature variances over time:

One suspects there may be for the PDO.

Everything here is meaned on 60, to make it all clearer. Hadcrut3 has been added for temps (purple line):

Same thing, meaned over 120 samples:

Looking at these last two graphs, I suspect that temps push PDO, but that changes in sunspot cycle intensities and lengths kind of "shake" AMO, thus suggesting a possible mechanism by which solar cycle changes might have an intensified effect on earth climate (aside from pure energy inputs). What I am hypothesizing is basically that shorter/stronger sunspot cycles insert more energy into the natural Atlantic oscillation, enhancing its swings, and that slower, weaker sunspot cycles dampen the AMO oscillation.

Tisdale's website has a lot of info on AMO and northern latitude warming. I don't have an opinion on causation, but it does seem that high AMO correlates with warmer Arctic.

Normally, AMO seems to go into its high phase and bobble around there for quite some time, meaning that one would expect a warmer Arctic and higher AMO for some years to come (240 sample mean):

But, if my theory is true, the phase shift on the AMO might be more acute because of the shift in sunspot activity, if indeed the lower solar activity persists for several cycles.

This all matters only if you like to eat. There's a huge amount of arable land up in the higher northern hemispheres, but historically northern crop failures have correlated with drops in sunspot cycles.

There is also real debate about whether we are overstating the difference in sunspot cycles due to better observations, which thus overstate recent variability as opposed to historical variability.

There is one thing of which I am certain, and that is that while CO2 should have some temperature effect, the "pure" CO2 effect just can't be that strong. Tropospheric temperatures should be the most sensitive to CO2-caused temperature variations, and look what happened to those when the sunspot cycle shifted:

It may be that CO2 prevents temperatures from falling as fast as they otherwise would, because it is trapping more heat. But it cannot be that CO2 alone has driven all the temperature rise recently, because its effect in the atmosphere is just not suddenly going to change. Lord knows CO2 levels aren't dropping and aren't going to drop any time soon.

In terms of predictions, so far the current people have dropkicked the climate scientists all the way around the globe, and now the solar people are lining up for the next go-round.

And the thing is, folks, that it's been a cold summer in the Arctic:

But what's odd about this is that we are pretty much at solar maximum. If you go to the website from which I thieved the graph, you discover that you can flip back and look at Arctic temps since 1958.

2009/2010 was the last solar minimum:

It was cold. You can plot all sorts of climate series at ESRL NOAA. So I did:

Purely out of random curiosity, I thought I'd use the first website to see if there was any pattern in summer Artic temperatures between sunspot maximums and minimums. And you know, there did seem to be a small but persistent effect. Try it yourself.

But this year, it's darned cold up there at solar maximum:

Which looks quite different from the last biggie, 1991:

All of which made me wonder if maybe it's time to stop hoarding gold, and start hoarding pasta?

And no, the Arctic is not exactly a lake this year:

At this point, if he were alive my father would be in fits of laughter, cheerfully reminding us all that he had always said that in terms of reliability between the sciences, geology came first, followed by physics. Sociology dead last. Yes, Dad, you were right - but I think we have a new contestant for dead last in climate science.

Although I do not know what it all means, I suspect that investing in farmland in Canada is not the wisest strategy.

MaxedOutMama

MaxedOutMama