Friday, December 12, 2008

One Big Lie

If you aren't following the Madoff story, you should begin to. This is not going to charge the Street with holiday spirits. It probably will spawn an outbreak of drinking to excess.

A bunch of his clients were hedge funds. Of course, when you are paying clients with money from other clients, you can (for a while) deliver much higher returns than the market warrants. Bloomberg's got a good article:

It sounds like they moved in to prevent the money from being distributed. This guy's a big name.

The reason I think everyone should follow this story is that one of the constant suggestions to "fix" the financial crisis is to remove mark-to-market. OK, that's what this guy basically did.

Any time you aren't marking to market, you are misrepresenting current value and cooking the books. Furthermore, making this legal would greatly reduce confidence between banks and financial firms. If you don't know what their current holdings are really worth, how can you know whether you are doing business with someone who can pay you back? Cash flow is not a reliable indicator for financial firms - relying on cash flow is exactly what Madoff did.

Turning the entire industry into a ponzi scheme isn't going to solve anything.

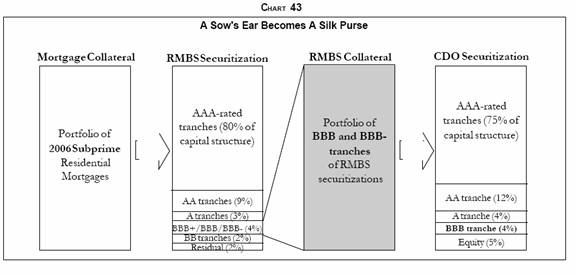

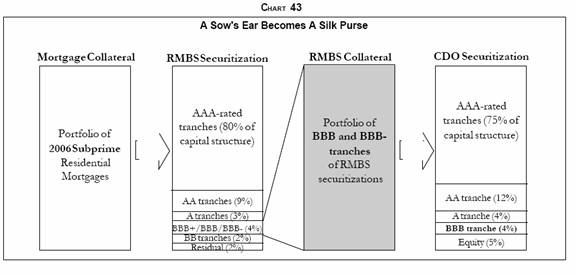

Update: Okay, Jimmy J is still arguing with me about mark-to-market. But his arguments seem to be based on ignoring the tranching system that created the certainty of high losses on some investment types when a coordinated economic downturn developed. See this Mauldin article about the problem, and here's a chart:

Thus, a very small shift in expected payout ratios on a pool of mortgages that spawned this chain of securities can be expected to deliver whopping default ratios to the securities at the end of the line. As Mauldin observed:

And of course the market is illiquid. During the run up, the B tranches were greatly beloved of some dipshit hedgies who weren't gutsy enough to buy the insurance company disaster bonds. Because of the payment structures, those low-grade tranches actually paid out large and rapid returns in a time of rapid prepayments (such as those delivered by house flippers and loans resetting to much higher payments within 2-3 years, thus triggering a refinance). It is those large returns that hedgies must have in order to justify the 2 and 20. As soon as the music stopped, those same tranches were toxic waste. It is true that the market is now illiquid, but that is because these investments are Rube Goldberg machines engineered to be very sensitive to risk and loss. If loss and risk is low, they pay off handsomely. If loss and risk is median, they suck and become illiquid unless you can find someone stupid to buy them. ( In the innovative world of structured finance, that means buy 'em up, pool them, and re-tranche.) If loss and risk moves higher, they splat.

In short, I don't want to hear any more nonsense about mark-to-market being the problem. That's as if I go to the doctor, the doctor finds a lump in my breast and sends me for a biopsy, and I refuse to go and instead sue the doctor for pain and distress. The messenger is not the friggin' problem.

A bunch of his clients were hedge funds. Of course, when you are paying clients with money from other clients, you can (for a while) deliver much higher returns than the market warrants. Bloomberg's got a good article:

While meeting the pair at his home yesterday, Madoff conceded that he was “finished,” that his advisory business is “all just one big lie” and “basically, a giant Ponzi scheme,” the government said. The business had been insolvent for years with losses of about $50 billion, he told the employees, according to the criminal and SEC complaints.He's obviously got some ethics. I guess we'll find out more about the structure of the scheme later, in court. It sounds like he didn't start out intending to commit fraud, but backed into it thinking he was covering a cash flow shortfall.

Madoff said he had about $200 million to $300 million left and planned to distribute money to select employees, family and friends before surrendering to authorities in about a week, the government said.

It sounds like they moved in to prevent the money from being distributed. This guy's a big name.

The reason I think everyone should follow this story is that one of the constant suggestions to "fix" the financial crisis is to remove mark-to-market. OK, that's what this guy basically did.

Any time you aren't marking to market, you are misrepresenting current value and cooking the books. Furthermore, making this legal would greatly reduce confidence between banks and financial firms. If you don't know what their current holdings are really worth, how can you know whether you are doing business with someone who can pay you back? Cash flow is not a reliable indicator for financial firms - relying on cash flow is exactly what Madoff did.

Turning the entire industry into a ponzi scheme isn't going to solve anything.

Update: Okay, Jimmy J is still arguing with me about mark-to-market. But his arguments seem to be based on ignoring the tranching system that created the certainty of high losses on some investment types when a coordinated economic downturn developed. See this Mauldin article about the problem, and here's a chart:

Thus, a very small shift in expected payout ratios on a pool of mortgages that spawned this chain of securities can be expected to deliver whopping default ratios to the securities at the end of the line. As Mauldin observed:

That means that if those RMBS lose just 5% of their value, everything but the AAA portion of the CDO is wiped out. Any losses beyond that start eating into the value of what a rating agency said was AAA! If the Greenwich projections are right (and these are very serious analysts), then all 2006-vintage CDO's will lose their AAA rating when the rating agencies look at them again.Guess what happened? Pool losses on a lot of "innovative" mortgages are already exceeding 20%; naturally the end-of-the-line securities saw their valuations drop like a stone.

And of course the market is illiquid. During the run up, the B tranches were greatly beloved of some dipshit hedgies who weren't gutsy enough to buy the insurance company disaster bonds. Because of the payment structures, those low-grade tranches actually paid out large and rapid returns in a time of rapid prepayments (such as those delivered by house flippers and loans resetting to much higher payments within 2-3 years, thus triggering a refinance). It is those large returns that hedgies must have in order to justify the 2 and 20. As soon as the music stopped, those same tranches were toxic waste. It is true that the market is now illiquid, but that is because these investments are Rube Goldberg machines engineered to be very sensitive to risk and loss. If loss and risk is low, they pay off handsomely. If loss and risk is median, they suck and become illiquid unless you can find someone stupid to buy them. ( In the innovative world of structured finance, that means buy 'em up, pool them, and re-tranche.) If loss and risk moves higher, they splat.

In short, I don't want to hear any more nonsense about mark-to-market being the problem. That's as if I go to the doctor, the doctor finds a lump in my breast and sends me for a biopsy, and I refuse to go and instead sue the doctor for pain and distress. The messenger is not the friggin' problem.

MaxedOutMama

MaxedOutMama